How to Calculate Present Value Compounded Continuously Formula

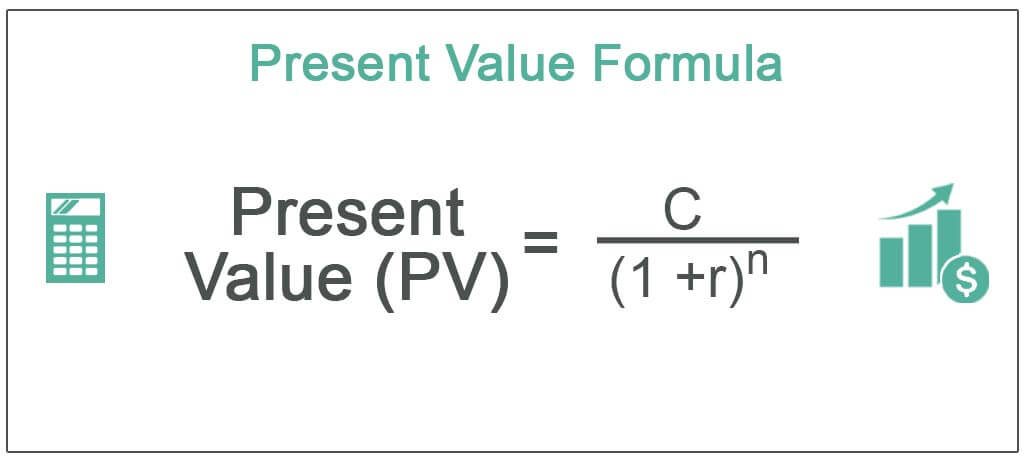

Formula to Calculate Present Value (PV)

Present value, a concept based on time value of money, states that a sum of money today is worth much more than the same sum of money in the future and is calculated by dividing the future cash flow by one plus the discount rate raised to the number of periods.

Table of contents

- Formula to Calculate Present Value (PV)

- Calculation of Present Value (Step by Step)

- Examples

- Example #1

- Example #2

- Relevance and Uses

- Recommended Articles

PV = C / (1 + r) n

You are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Present Value Formula (wallstreetmojo.com)

where, PV = Present value

- C = Future cash flow

- r = Discount rate

- n = Number of periods

For a series of future cash flows with multiple timelines, the PV formula can be expressed as,

PV = C1 / (1 + r) n 1 + C2 / (1 + r) n 2 + C3 / (1 + r) n 3 + ……. + Ck / (1 + r) n k

Calculation of Present Value (Step by Step)

- PVi = Ci / (1 + r) n i

- PV = C1 / (1 + r) n 1 + C2 / (1 + r) n 2 + C3 / (1 + r) n 3 + ……. + Ck / (1 + r) n k

Examples

You can download this Present Value Formula Excel Template here – Present Value Formula Excel Template

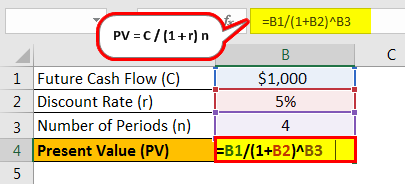

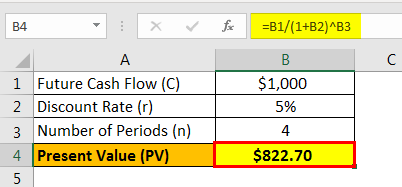

Example #1

Let us take the example of John who is expected to receive $1,000 after 4 years. Determine the present value of the sum today if the discount rate is 5%.

Given,

- Future cash flow, C = $1,000

- Discount rate, r = 5%

- Number of periods, n = 4 years

Therefore, the present value of the sum can be calculated as,

PV = C / (1 + r) n

= $1,000 / (1 + 5%) 4

PV = $822.70 ~ $823

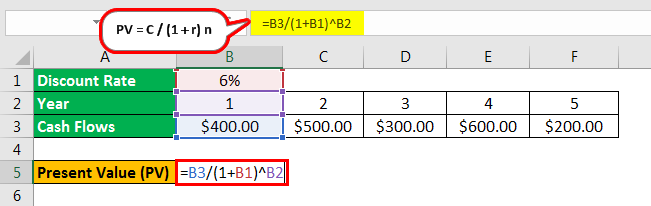

Example #2

Let us take another example of a project having a life of 5 years with the following cash flow. Determine the present value of all the cash flows if the relevant discount rate is 6%.

- Cash flow for year 1: $400

- Cash flow for year 2: $500

- Cash flow for year 3 : $300

- Cash flow for year 4: $600

- Cash flow for year 5: $200

Given, Discount rate, r = 6%

Cash flow, C1 = $400 No. of period, n1 = 1

Cash flow, C2 = $500 No. of period, n2 = 2

Cash flow, C3 = $300 No. of period, n3 = 3

Cash flow, C4 = $600 No. of period, n4 = 4

Cash flow, C5 = $200 No. of period, n5 = 5

Therefore, calculation of present value Present Value (PV) is the today's value of money you expect to get from future income. It is computed as the sum of future investment returns discounted at a certain rate of return expectation. read more of cash flow of year 1 can be done as,

PV of cash flow of year 1, PV1 = C1 / (1 + r) n 1

= $400 / (1 + 6%)1

PV of cash flow of year 1 will be –

PV of cash flow of year 1 = $377.36

Similarly, we can calculate PV of cash flow of year 2 to 5

- PV of cash flow of year 2, PV2 = C2 / (1 + r) n 2

= $500 / (1 + 6%)2

= $445.00

- PV of cash flow of year 3, PV3 = C3 / (1 + r) n 3

= $300 / (1 + 6%)3

= $251.89

- PV of cash flow of year 4, PV4 = C4 / (1 + r) n 4

= $600 / (1 + 6%)4

= $475.26

- PV of cash flow of year 5, PV5 = C5 / (1 + r) n 5

= $200 / (1 + 6%)5

= $149.45

Therefore, the calculation of present value of the project cash flows is as follows,

PV = $377.36 + $445.00 + $251.89 + $475.26 + $149.45

PV = $1,698.95 ~ $1,699

Relevance and Uses

The entire concept of the time value of money The Time Value of Money (TVM) principle states that money received in the present is of higher worth than money received in the future because money received now can be invested and used to generate cash flows to the enterprise in the future in the form of interest or from future investment appreciation and reinvestment. read more revolves around the same theory. Another exciting aspect is the fact that the present value and the discount rate are reciprocal to each other, such that an increase in discount rate results in the lower present value of the future cash flows. Therefore, it is important to determine the discount rate appropriately as it is the key to a correct valuation of the future cash flows.

Recommended Articles

This has been a guide to the Present Value Formula. Here we discuss the calculation of the present value using its formula along with examples and a downloadable excel template. You can learn more about financial analysis from the following articles –

- Present Value Factor Present value factor is factor which is used to indicate the present value of cash to be received in future and is based on time value of money. This PV factor is a number which is always less than one and is calculated by one divided by one plus the rate of interest to the power, i.e. number of periods over which payments are to be made. read more

- PV vs NPV Present value (PV) is the present value of all future cash inflows in the company during a particular time. In contrast, net present value (NPV) is derived by deducting the current value of all the company's cash outflows from the present value of the total cash inflows of the company. read more

- Net Present Value Formula Net Present Value (NPV) estimates the profitability of a project and is the difference between the present value of cash inflows and the present value of cash outflows over the project's time period. If the difference is positive, the project is profitable; otherwise, it is not. read more

- Quantitative Research Examples Quantitative research examples include using the mean for an opinion poll, calculating portfolio return, risk assessment, and calculating average annual return. read more

Source: https://www.wallstreetmojo.com/present-value-formula/

0 Response to "How to Calculate Present Value Compounded Continuously Formula"

إرسال تعليق